No one can predict the future when it comes to business electricity and gas prices.

However, the long term trend for the past 50 years has been to go up.

That said all the info below is meant for informational purposes only and should not be relied upon to make financial decisions.

Here’s is some key data from the 2025 Business Electricity Price Index Statistics and Ofgem Wholesale market indicators.

- Since 2004 average business electricity prices have increased 538% from 3.72p/kWh to 23.77 p/kWh

- The annual prices decreased from Q2 2024 to Q2 2025 by 6.7% YoY from 25.47p/kWh to 23.77p/kWh

- Very Large business energy customers have seen the biggest increase in rates from 2004 to 2025 at 676%!

- Very small business energy customers saw the largest increase in the last 12 months at 25%, the only group to have an increase.

- Business electricity rates are 28X higher than they were in 1970.

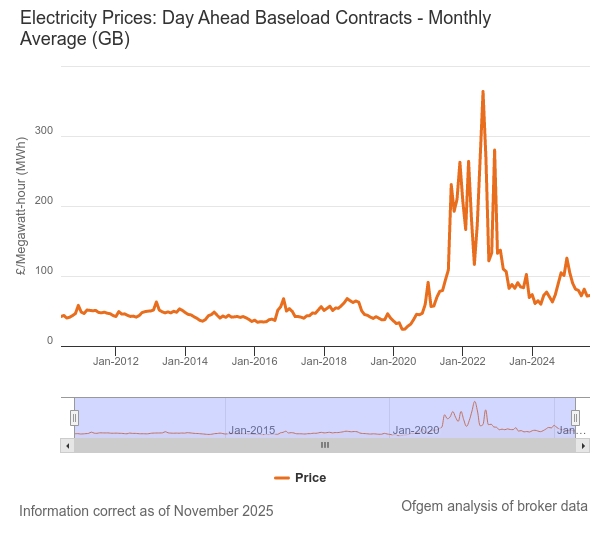

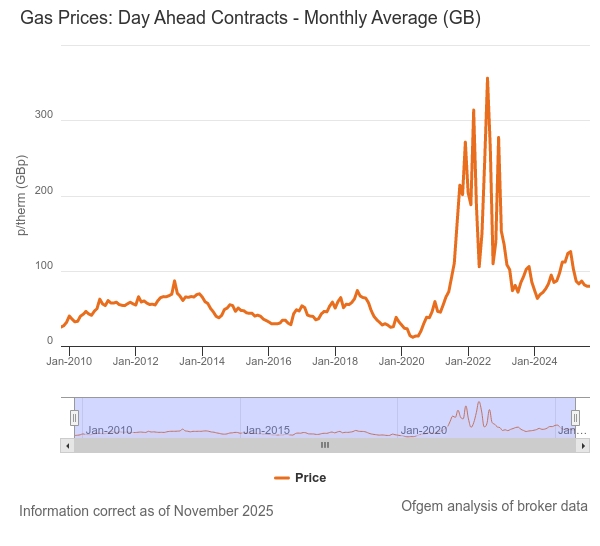

And here’s Ofgem Day Ahead Rates for both electricity and gas:

Day ahead contracts show the price evolution in the spot market.

These markets can be very volatile and impact the forward price trends shown below.

Market Competition

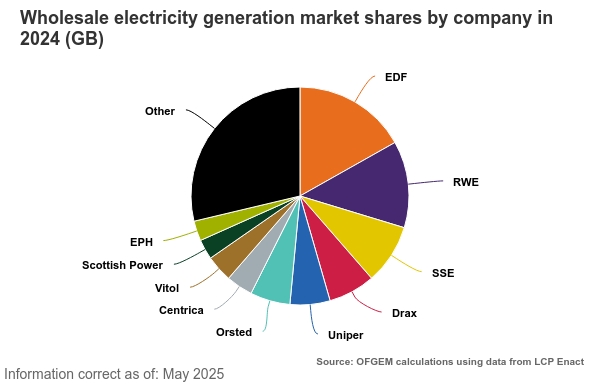

This chart shows the market shares of companies who supply electricity to the GB National Transmission System by year.

The companies with the largest 10 market shares are identified largest to smallest, with all other companies shown as ‘Other’.

Long-term trend (past ~10 years)

- Over the last decade, business/industrial energy prices in the UK have generally trended upwards, though the rate of increase varied and there have been fluctuations.

- The industrial energy-price statistics from the Department for Energy Security and Net Zero (DESNZ) show that UK industrial electricity prices have been significantly above the average of the OECD/IEA over the last 10 years. Source: Office for National Statistics

- Renewables’ increasing share (wind/solar) have had some downward pressure on electricity wholesale prices, but not enough to reverse the overall upward trend in business tariffs (because other cost components – fuel/gas, network, policy/levies – also rose).

- The “energy crisis” of 2021-22 (gas, supply issues, Russia-Ukraine war) stands out as a large upward shock in price. Many business tariffs fixed during that time locked in higher rates.

Summary: Are business energy prices going up now & why?

- Yes, compared to a few years ago prices are higher.

- The big jump was in 2021-22. Since then, some easing/normalisation but not a full return to pre-pandemic lows.

- If you are renewing now or have contracts expiring, you should assume rates will be elevated relative to say 2015–2019.

- The upward pressures come from: wholesale fuel/gas prices, policy/levy costs, network costs, supply chain/hedging risk, and inflationary cost base.

- There is some downward risk (if fuel/wholesale markets improve) but also upside risk (geopolitics, cold/higher demand, supply disruptions), so the risk premium remains.

Implications for your business

- If your contract expired in recent months and you’re getting quotes, you should accept that “normal” now is higher than “normal” 5-10 years ago.

- If you expect to fix a contract, you should factor in that you might be paying more than historic minimal levels.

- If you are on out-of-contract (deemed) rates, you should expect those to be relatively high and compare carefully.

- When budgeting, think of “stable but elevated” rather than “cheap and sliding”.